More businesses today are embracing IT as a service (ITaaS) and cloud environments, says a new McKinsey & Company report. “In the next three years, enterprises will make a fundamental shift from building IT to consuming IT,” forecasts the consultancy’s ITaas Cloud and Enterprise Cloud Infrastructure survey. Here, Ironpaper shares ITaaS, cloud market insights highlighted in the September report.

Drawing on survey responses from approximately 800 CIOs and IT business execs worldwide McKinsey observed, “The cloud debate is over—businesses are now moving a material portion of IT workloads to cloud environments.”

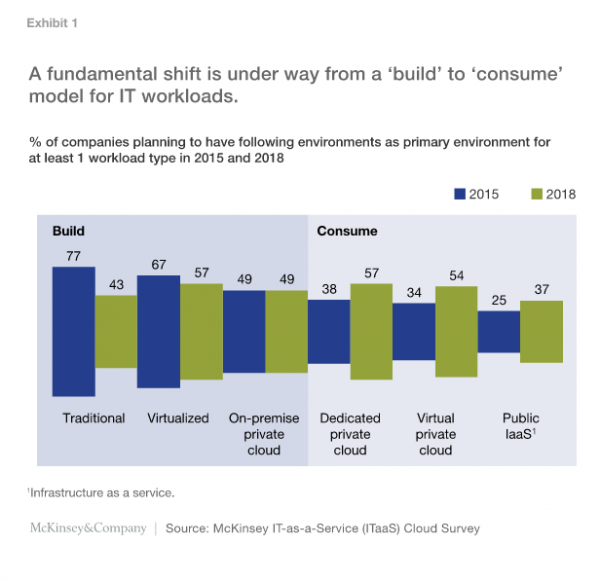

In 2015, 77% of enterprises used traditionally built IT infrastructure as the primary environment for at least one workload; by 2018, this will drop to 43%.

While on-premise private cloud environments are expected to remain nearly flat, dedicated private cloud, virtual private cloud, and public infrastructure as a service (IaaS) are expected to see substantially higher rates of adoption.

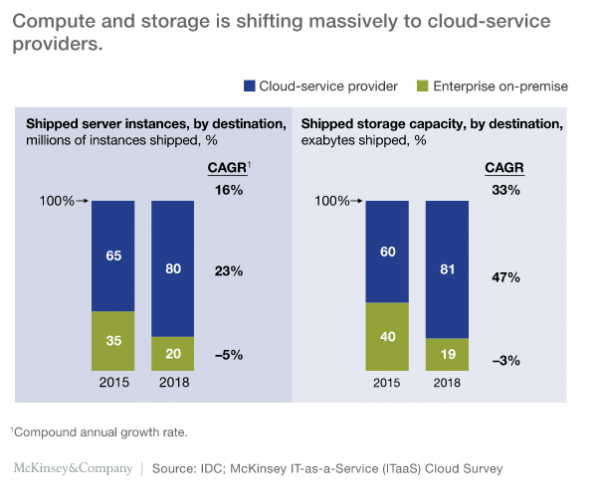

Server instances and storage capacity are shifting massively into cloud-service providers. In fact, the study forecast a negative compound annual growth rate for on-premise shipper server instances and storage capacity from 2015 to 2018.

What’s driving this greater move to hybrid cloud infrastructures?

Enterprises’ adoption of IaaS as the primary environment for workloads will jump from 10% in 2015 to 51% in 2018.

The research highlighted a marked preference for “hyperscale” providers such as Amazon, Google, and Microsoft. Some 48% of large enterprises had handed off-premise workloads to a hyperscale provider already. McKinsey predicted the number would rise to roughly 80% by 2018.

Nevertheless, security and compliance remain key concerns, particularly for large enterprises, the study found. In fact, security and compliance were the most important considerations in selecting cloud service providers, with cost only the third most important factor.

Who will ultimately benefit?

Here are some additional Cloud Services Insights from other sources.

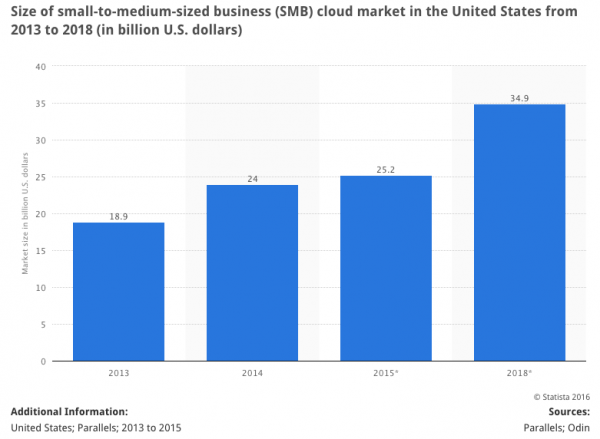

For an idea of how small- to medium-sized businesses are accessing cloud computing:

Source: Parallels; Odin

Source: Parallels; Odin

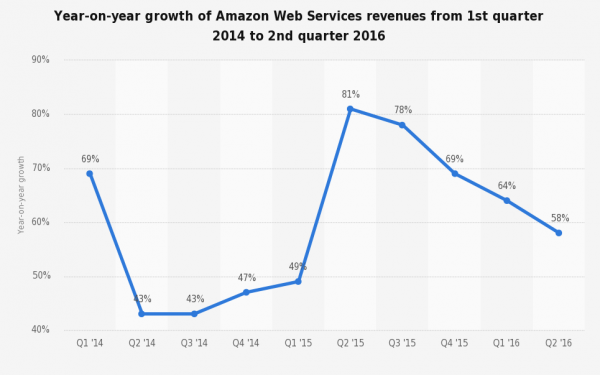

Plus, even though Amazon was highlighted by McKinsey as one of the hyperscale providers of choice, it has seen rising and falling revenues in the past two years:

Source: Amazon

Source: Amazon

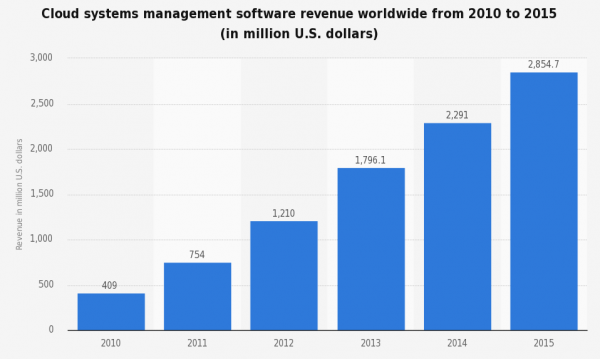

Cloud systems management software revenue worldwide from 2010 to 2015. In 2015, the global cloud systems management software market had a value of $2.8 billion.

Source: IDC

Source: IDC

Leveraging the cloud solution and application market opportunity requires thoughtful marketing.

ITaaS Insights Sources:

Elumalai, A. Starikova, I., & Tandon, S. (2016, September). IT as a service: From build to consume. https://www.mckinsey.com/industries/high-tech/our-insights/it-as-a-service-from-build-to-consume

by Jonathan Franchell, CEO of Ironpaper - For more tips and hacks: Need to remove a new line after h1 tags? Both web designers and SEO practitioners need to employ headline tags: H1, H2, H3 in several ways to improve web page structure and tag...

The Crowded Arena of the IT Marketplace Updated December 2024 The Information Technology (IT) landscape is experiencing rapid growth and intensifying competition. IT spending is projected to reach nearly 5.1 trillion U.S. dollars in 2024, a...

Updated December, 2024 The field of digital marketing is evolving rapidly in response to new technology and changing buyer expectations. To help career-minded marketers, we’ve rounded up the top 10 skills needed to succeed in the field. These are...

The marketing industry is transforming significantly due to generative AI and increasing market complexity. Gartner's prediction of a 25% decline in traditional search traffic suggests that the era of search engines is dying. AI tools, particularly...